It’s been said that there are two things in life that are certain: death and taxes. While this is certainly true today, you may wonder if it’s always been the case. Taxes have been a way of life in the United States since the colonial times, but where did they originate? Originally a gift from the King of England, taxes have always been around in our country, and they always will be. However, they have undergone some changes over the years.

Taxes are as Old as Civilization

Taxes are quite nearly as old as civilization. It is believed that the first taxes were levied in Egypt. The tax collectors were known as scribes, and one recorded tax was on cooking oil. All great cultures since then have made use of taxes to build roads, expand empires and protect countries. Taxes have been around for millennia, and they will probably be around as long as we have civilized cultures.

Internal Taxes and Tariffs

In every civilization, somebody needs to pay the taxes. The burning question is always who. Taxes in the United States were initially limited to internal taxes on goods like distilled spirits, refined sugar and tobacco. When the government needed more funds to win the War of 1812, luxury items like gold, jewelry and watches started being taxed.

In 1817, a drastic shift in taxes took place. At that point, the citizens of the country were able to transfer their tax burden to somebody else by charging tariffs. Rather than paying for the goods they used, they charged the companies who were shipping goods over to the young country.

The Joyful Income Tax and Others

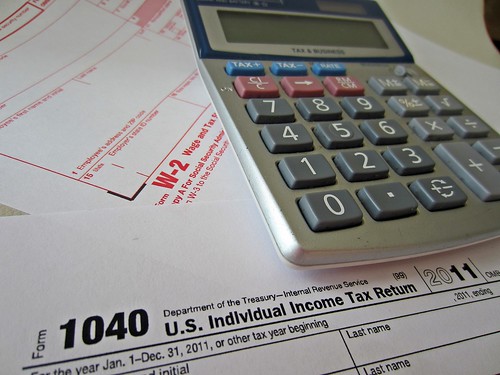

By 1862, the country had been surviving off internal taxes and tariffs. However, there was another tax waiting in the wings. That year, Congress enacted the first income tax to support the Civil War. This era also saw the introduction of sales taxes, excise taxes and even the dreaded inheritance tax.

The Tax Foundation has assembled information on tax rates over the last century. In 1913, the marginal income tax level was one percent, and the highest bracket was six percent. The year 1916 saw a drastic shift in tax brackets. The lowest doubled to two percent, and the highest level more than doubled to 15 percent. Tax levels continued to rise for the next half-century. By 1980, the top earners in the country were paying 70 percent in income tax. This rate was reduced to 50 percent in 1982, and reduced again in 1986 to 35 percent. The rate was briefly lower in 1988 and 1989 at 28 percent, but it currently holds steady at 35 percent.

Oliver Wendell Holmes once said that taxes are the price we pay for civilized society. This beautifully sums up the basic fact of taxes. They are necessary to build infrastructure that everyone benefits from, including school, roads and hospitals. Even most people who are opposed to raising tax rates will concede that some level of taxation is necessary. What that level is changes over the course of time, but we will always have some form of taxes to keep our society intact and civilized.

– Keith Wright writes for several higher ed blogs. Several universities offer taxation degrees including NEU and Rutgers.